Does social media even work?

How long will it take until I start to see leads coming through?

These are the most common questions we get asked on a daily basis when financial advisers are looking to invest in marketing and social media.

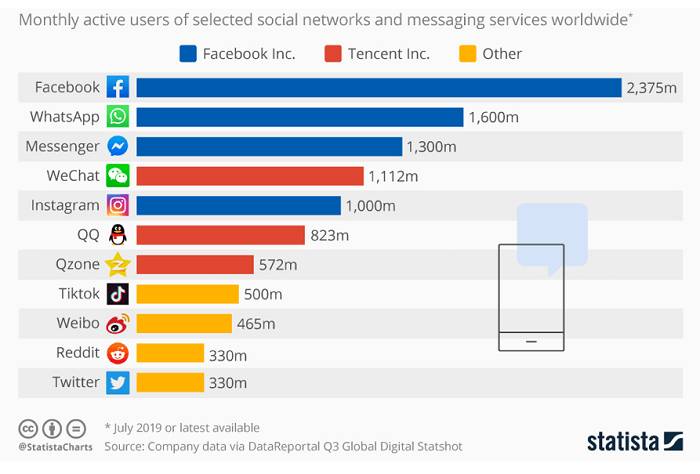

Let’s all agree on one thing before we dive into this article: The picture below says all we need to say about WHY you and your business need to be on social media:

Until 2020, social media wasn’t really on the radar for most mortgage advisers.

This is because the main source of leads was through word of mouth, natural footfall from the high street, and networking events.

Today customers expect you to be available to them wherever they are. This means you need a presence on multiple channels.

Social media can be a huge part of your multi-channel communication strategy with your clients. By taking advantage of social media you’ll make it easier for your customers and potential customers to stay connected to you.

In this article, we shall explore:

- The key benefits of using social media as a mortgage adviser

- How social media can help you generate mortgage leads

We hope this article helps shift your mindset towards social media, and give you more confidence to use it.

If you’re fairly new to posting on social media for business, we recommend that you brush up on some up to date social media DOs and Don’ts here.

The Key Benefits of Using Social Media in a Mortgage World

In today’s new normal, the modern consumer is sophisticated. Consumers want to stay fully informed at all times and they do their research before engaging with any new brand or company.

Your clients have A LOT of choice.

Within financial services, there are approximately 15,000 mortgage advisers in the UK – so how can you stand out? How will clients find you?

93% of customers read online reviews before buying a product.

According to BIA/Kelsey and ConStat

Trust is a big part of attracting new customers, and that’s logical right? Your prospective clients have been saving their hard earned cash for years, so they want to make sure they are using the most reliable and trusted adviser to handle their investments.

Building an online presence allows your customers to get to know you on their own terms. Each online touchpoint and exposure with your brand is an opportunity to build their trust and nudge them closer to giving you a call when they are ready to commit.

Here are the key benefits to being online:

Visibility

Out of sight out of mind!

Consumers have a lot of choice when it comes to choosing the right mortgage adviser.

Being on social media and having a strong online presence means you have more of a chance of being found by consumers who are doing their research and shopping around for the best solution.

Beat the competition

When customers are doing their research, they are comparing companies and services so you want to make sure you’re at least in the line up!

If you’re not on social media, you can bet your competition is!

Build relationships

People buy from people.

You can instantly tell from someone’s social media profile or website whether or not you would like to work with them or not. Having a social media presence means you can interact with your audience. Social media is about being social. This business is about relationships so start to build relationships through online platforms too!

Establishes authority

Clients have got access to the majority of the mortgage products on the market via the internet.

Information is available at their fingertips.

So how can you make all the difference?

By showcasing your knowledge, expertise, and experience through the content you publish on your website and social media,…

Builds trust

Having NO reviews or NO online visibility can in fact be more damaging for your brand than actually having a few bad reviews here and there.

Clients like to read reviews and testimonials to learn more about the pros and cons with any organisation. This helps them understand and prepare what they are getting into.

Also, don’t be frightened of the odd bad review. It is better to have TRUE testimonials and reviews on your website because it shows your experience and HUMAN side.

We don’t expect perfection. As customers we expect transparency and honesty. Having a bad review and dealing with it well, shows your integrity and professionalism.

Increasing the visibility of your brand and services enhances your chances of building trust with your audience.

Consistency, repetition and great quality content will help you convey a strong and reputable brand.

Builds rapport

On average it takes 7 exposures between brand and consumer before the consumer decides to purchase anything.

If you want to increase the chances of working with a prospect … you guessed it… you need to increase the number of exposures. The more visible you are amongst your prospects the most chances you have at building rapport with someone who is currently researching your proposition.

Social media platforms are ideal for rapport building because they are built for ENGAGEMENT!

Platforms have made it very easy for anybody to post something on the go making it very accessible for people to stay connected.

Platforms like Instagram, Facebook and LinkedIn are great for networking with people online because each platform has all the functions you need to stay informed and connected.

These social platforms allow you to chat, follow, comment, like, save information and SHARE information. Not only this, they are algorithmically designed to increase engagement and build communities, making them ideal places for you to build a brand and serve your online community.

If you’re already on LinkedIn making professional connections then we have more guidance for your here → How to use LinkedIn to increase your Sales Prospects

Adds value

Unlike a website (unless you have live chat) your customers can chat to you through social media

Sometimes clients want to ask a quick question to complete their research before taking things further. For example, a couple may have seen the advertisement above and they may not be in position to pick up the phone and speak to an adviser so they just want to ask a quick question.

Social media allows you to be accessible to your clients in many different ways. Through these social media platforms clients can access quick information to help them along their journey before committing to a face to face meeting or telephone consultation.

This is very helpful to your prospect and therefore will find your social pages valuable because it helps them learn more about who you are and what you do.

What next ? Where to start and what to learn next

Make sure your social media profiles are fit for purpose – as the official online first impression of you and your business they need to be branded, professional, informative and interactive.

Our Social Media gurus at The Content Hive are on a mission to help you optimise your profiles and get you up and running on social media.

Fill in the form below to receive a FREE LinkedIn M.O.T, where we’ll break down the steps you need to take to be LinkedIn ready!